In the fast-paced world of financial markets, staying on top of the competition requires not just skill and knowledge, but also the right tools. Trading software has emerged as a revolution, providing traders with the exactness and efficiency needed to navigate challenging financial landscapes. By utilizing cutting-edge technology, traders can scrutinize vast amounts of data, carry out transactions with speed, and manage their holdings efficiently. The advantages of these software tools extend beyond mere convenience, offering a strategic advantage that can significantly impact overall earnings.

Investing in a reliable trading system can lead to improved decision-making, as it offers real-time insights and data analysis that human intuition alone cannot match. With features such as automated trading, backtesting capabilities, and personalized alerts, traders can create a methodical approach to trading. This move towards mechanization not only lessens emotional trading decisions but also allows for increased attention on future goals. As more traders realize the advantages of incorporating trading software into their routines, it becomes apparent that those who gain from exactness will likely dominate the markets.

Comprehending Trading Systems

A trading framework is a detailed framework that sets forth a collection of guidelines and tactics for executing trade choices. It includes aspects such as buying and selling points, risk management, and market assessment. By following a systematic approach, investors can eradicate emotional biases and make more knowledgeable decisions based on analytical insights. This method is essential for managing the complexities of the financial world, where changes can happen quickly.

Many trading frameworks make use of automated tools that automate the process of evaluating market dynamics and executing trades. These tools can analyze large amounts of data far more efficiently than humans, detecting trends and prospects that may simply go overlooked. By adopting automated processes, traders can optimize their strategies, simulate different cases, and adjust their approaches based on past results. This automation not only improves correctness but also conserves valuable time and effort.

Additionally, these frameworks provide a systematic methodology for managing risks. By clearly defining parameters for risk levels, position sizing, and portfolio diversification, investors can protect their funds while seeking their investment objectives. This framework fosters a more strong trading plan, allowing traders to withstand market swings without falling into fear or impulsive decisions. Overall, a carefully crafted trading system is a critical resource for anyone seeking to prosper in the world of finance.

Key Features of Trading Software

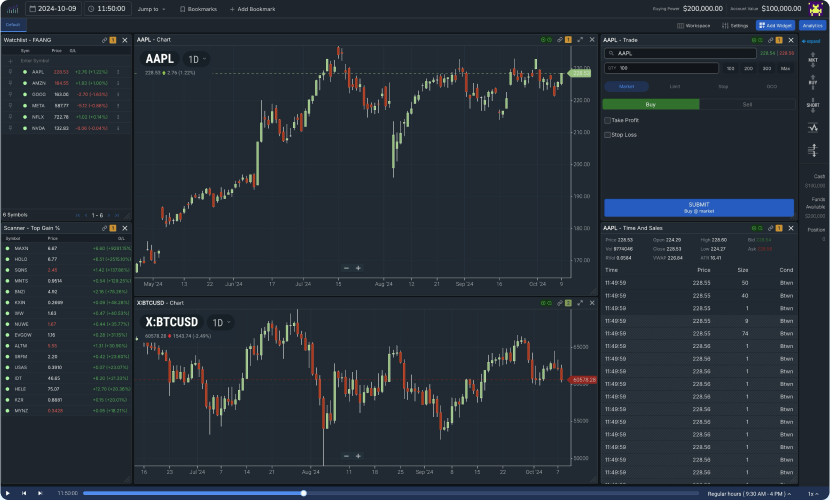

Trading platforms offers a variety of functions that boost the trading process and increase results. One of the main features is live market analysis, which gives users access to current data on market fluctuations and price movements. https://www.tradesoft.es/ allows for rapid decision-making, enabling traders to capitalize on situations as they arise. With advanced algorithms, the platform can analyze extensive amounts of data, providing traders with information that would be difficult to gather by hand.

Additionally, crucial feature is automatic trading functions. This function allows traders to set particular parameters for their trades, enabling the software to execute buy and sell requests automatically based on set criteria. This not only saves time but also helps eliminate emotional decision-making, which can lead to costly mistakes. Automated trading mechanisms can operate around the clock, ensuring that trades are executed even when the trader is incapable to monitor the exchanges.

Lastly, risk mitigation tools are a critical aspect of trading software. These tools enable investors to establish stop-loss orders and take-profit levels to protect their funds. By managing risk effectively, investors can minimize potential losses while enhancing their profit potential. The integration of these tools ensures that users can develop a solid trading strategy that aligns with their risk appetite, ultimately leading to more consistent trading performance.

Benefits of Automation in Financial Trading

Automation in financial trading offers numerous advantages that significantly enhance the trading process. One of the main benefits is the ability to carry out trades instantly at the set criteria. This swiftness allows investors to capitalize on market opportunities without the hesitation that often accompanies manual trading. By eliminating the emotional component from the decision-making process, automated systems help maintain self-discipline and uniformity, which are essential for long-term success in volatile markets.

Another key benefit of trading automation is the ability to process vast amounts of data much faster than a person can. These automated trading systems utilize advanced algorithms that can process real-time market data, detect potential trends, and execute trades based on comprehensive analysis. This systematic approach not only helps in spotting lucrative trading opportunities but also mitigates risks by adhering to established strategies without being swayed by emotional influences or market fluctuations.

Furthermore, automation frees up valuable time for traders. Instead of spending time watching the markets and making trades, individuals can focus on developing strategies or other parts of their lives. The efficiency gained through trading software means that market analysis can be done in the background while automated systems handle execution. This allows for a more balanced approach to trading, where one can engage with the markets at a comfortable pace while still taking benefit of their potential.